If the tolerance amount is "0", all documents with identical reporting amounts, i.e. Tolerance amount to ignore rounding variances In the Comparison VIE/Intra Data filter, you can use various selection criteria to filter the documents that are displayed in the Comparison VIE/Intra Data window.

Variance between the OI amount and the invoice amount The OI amount is "0" if a document was included in the intra-EU trade statistics, but not in the VIE. For this reason, the OI amount is only displayed in the line The data of the VIE refer to the entire document (OI). The data of the intra-EU trade statistics refer to the individual document lines and are displayed line by line in the Comparison VIE/Intra Data window. The line number is "0" if a document was included in the VIE, but not in the intra-EU trade statistics. Important data in the Comparison VIE/Intra Data window include:

These differencesĬan be viewed in a comparison between the intra-EU trade statistics and the VIE in the Comparison VIE/Intra Data window. The intra-EU trade statistics, while the OI amount including the header surcharges is reported in the VIE. For example, the values of header surcharges are not reported in Reasons, intra-EU trade statistics and the VIE may differ. This means that identical/comparable facts are reported in intra-EU trade statistics and the VIE. Shipments of domestic companies to companies in other EU member countries are also reported in the report for intra-EU trade The pa_FO_A_ZM_Schluessel compiler constant defines the EU countries and tax codes for which sales are determined.Ĭomparing the data of intra-EU trade statistics and the VIE When the VAT information exchange report is output, the determination base of the OI is identified with a "2" in the columnĮxception: The Austrian VIE can be configured in such a way that sales are determined for specific EU countries and tax codes only. Shipments which were part of a triangular trade are reported The OI amounts from the tax cases "0" and "2" are combined. Intra-community supply of goods is reported, including intra-community transfers With the reference to miscellaneous services. When the VAT information exchange report is output, the determination base of the OI is identified with a "1" in the column Intra-community miscellaneous services, such as services performed in a country of the European Union, are reported ProALPHA determines the assignment of the sales to the sales categories as follows:Ĩ (Intra-Community Miscellaneous Services) With the account assignments defined for the VIE.Īpplication parameter FO_VATviaAccountAssignment defines the sales to be determined and the method for the determination. Sales are determined according to the tax case requiring reporting in the open item.

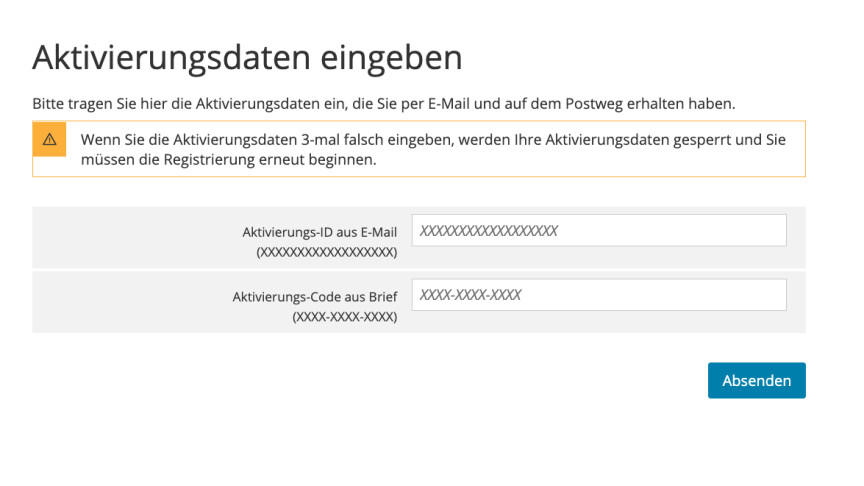

ELSTER ONLINE LOGIN STRUKTUR PIN CODE

The account assignment of sales tax code "41".ĭifferentiating the sales for creating the VIE lines These sales are included in the VIE if the "Clearing Account Intra-Community Transfer" special account has been defined in The determinationīase is determined at the exchange rate of the final invoice. Invoice are included in the report period in which the partial final invoice/final invoice has been posted. The partial payment invoice as well as the partial final invoice/final Shipments which were part of a triangular trade are reported.Ī partial payment invoice is included in the VIE if it has been reconciled in a partial final invoice or the final invoice for the corresponding partial payment transaction. Intra-community miscellaneous services, such as services performed in a country of the European Union, are reported. Intra-community supply of goods that has been delivered to a country of the European Union is reported. The following sales categories are differentiated in the VIE: You can then manually report the sales as required in the respective EU country, e.g., in an online portal. To do so, you select the OI report by your sales tax identification number You can determine these sales with the OI report. Note: Intra-community sales in an EU country which is not the country in which the company is based are not determined in the VIE.įor example, in the VIE of a German company, the sales from deliveries sent from an Austrian storage area are not determined. Of goods from Germany to another EU country are determined. For example, if the company is based in Germany, the sales from the intra-community supply In the VIE, the intra-community sales are determined which an EU company generated in the domestic country ( EU Country field in the company master files).

0 kommentar(er)

0 kommentar(er)